Customer lifetime value (CLV) is one of the most significant metrics to ascertain in any expanding business. If you desire your company to procure and retain extremely valuable consumers, then your team members must learn what consumer lifetime value is and how to compute it.

Nowadays, to assess your company’s growth, a single metric named, return on investment, is not sufficient. Recurring profit is the basis on which subscription business prototypes are developed. That is why it becomes critical to retain your consumers for a prolonged period – also known as the customer lifetime. Let’s understand this concept and its importance in business in 2021.

Table of Content

What is Customer Lifetime Value?

Customer Lifetime Value (CLV or CLTV) is a significant statistic that is likely to be traced as a fragment of a consumer experience platform. CLV is the measurement of how valued a consumer is to your business with a limitless timespan as contrasting to just the first procurement. Such a metric aids you comprehend a rational cost per attainment.

CLTV is the aggregate worth to a company of a user throughout his/her customer relationships.

It is an imperative metric as it charges less to keep the existing customers than it does to attain new ones, so mounting the worth of your present customers is a great method to attract growth.

For instance, if the CLV of any coffee shop consumer is $1,000 and it charges more than $1,000 to obtain a new customer through marketing campaigns, advertising, and offers, this coffee chain could be dropping money unless it clips back its attainment costs. CLTV aids the businesses to form strategies to gain new customers and retain the prevailing ones while upholding the profit margins.

Build an advanced knowledge base for your customers and give them answers fast – real fast.

Take your app and help center to the next level with CloudTutorial.

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) is the cost of convincing a potential consumer or transforming a prospect to become an actual consumer. CAC is a predominant business-level metric. It incorporates the cost of obtaining business across all the marketing tasks – offline and online, Google Ads and Facebook ads, billboards, and media placements, and even the costs of a store-front sign.

Expenditures you must comprise:

- The payroll of the marketing team

- Expenses related to the scheme of the ads

- Marketing budget software

- Ad expense of all campaigns – print, Facebook Ads, and Google Ads

The formula for CAC:

CAC = (Salary + Overheads + Paid Marketing + Tools) / Number Of New Customers

All these things – overhead, paid marketing, tools, and salaries should be taken into account when computing CAC on a macro level.

Customer Lifetime Value (CLV) vs Customer Acquisition Cost (CAC)

Nowadays, a couple of metrics related to advertising function are not essentially advertising-specific and are formulated to aid you to understand the company performance at varying levels.

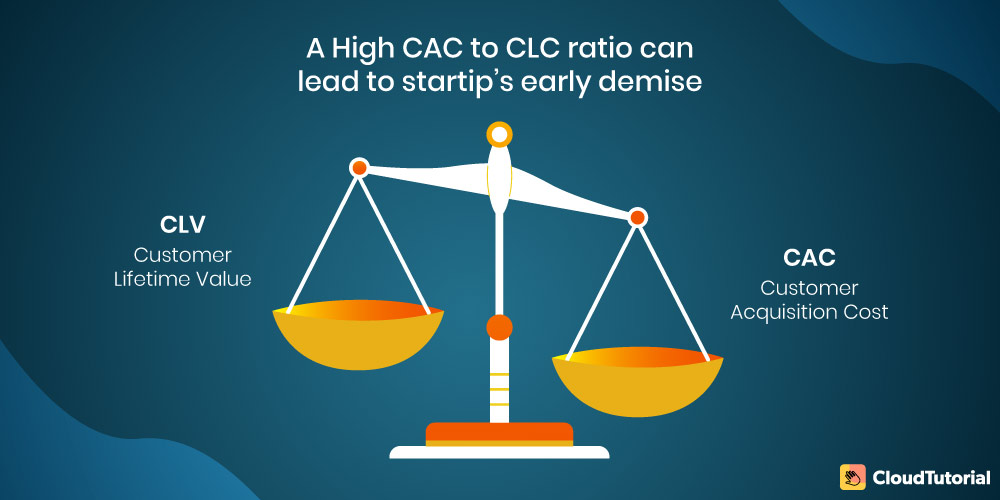

Customer lifetime value (CLV) and customer acquisition cost (CAC) are two different yet equally critical metrics. Let’s converse about why these metrics are important, how they are related, and how they differ.

- Logically, you are looking for a reverse relationship between CAC and CLV, with CLV being higher than the two. If it charges less to obtain a distinct customer, then the more general value consumer epitomizes and the more revenue you tend to make.

- Instead, look for a more productive technique to create the two numbers, utilize that as a baseline, and then function to push them separately over the duration. Permitting that margin to get too slender can result in some stability concerns.

- Similar to CAC, CLTV is not uniform. It is a good notion to compute one all-encompassing CLTV for your company, but you might also require to fragment your scheming based on the customer base.

- For example, if you have one CLV for the elementary iteration of the product development and one CLV for the more robust version, doing so – dividing CLV calculations based on the customer base – like fragmenting through the channel when you are calculating CAC, will permit you to trace the value over time and emphasis not only on which services or products are supplying your company with the most value, but also the ones that are moving down the overall CLV and can be upgraded.

- Both the metrics are critical and both narrate a discrete yet not unconnected section about how efficiently your company is being run, where you are losing money, and where you can recover.

- CLV is possibly the more desirable metric as it aids you to comprehend the bottom-line revenue, but, as stated, you cannot know CLV unless you know how much it charges to get a new customer.

You can employ these metrics collectively to produce a more holistic and thoughtful performance.

Reasons Why Customer Lifetime Value is Essential for Your Business

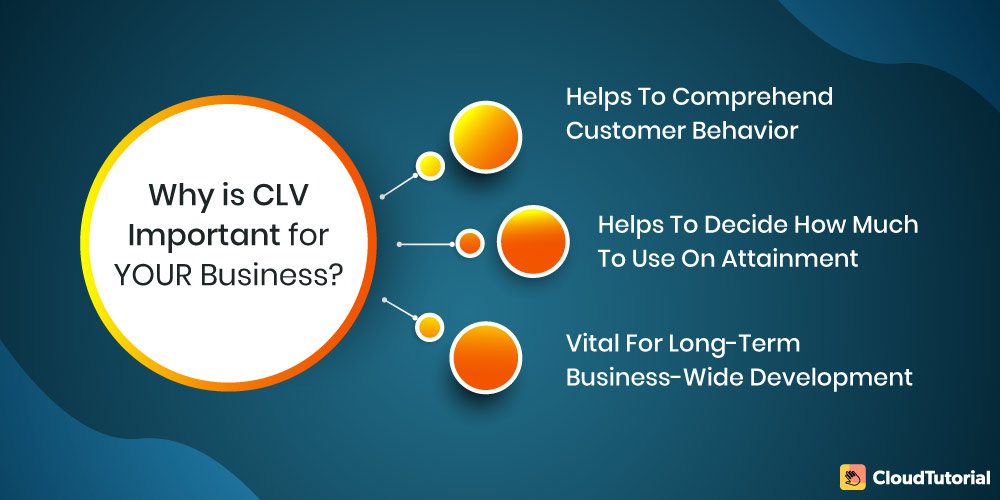

CLV is a significant metric as it delivers you with a consumer-centric viewpoint to monitor some crucial sales and marketing strategies of your SaaS business like retention, acquisition, upselling, cross-selling, and customer support.

Helps To Comprehend Customer Behavior

You can divide your consumer information into diverse classifications based on their ‘lifetime beliefs’. You can recognize clients who are expected to churn initially and respond proactively. To enhance customer retention indefinite sections, you can prolong special discount offers or rates. Another noteworthy advantage of consumer segmentation is that you can utilize duplicate modeling to obtain more high-value and similar customers.

Helps To Decide How Much To Use On Attainment

Without knowing how much money you can generate from a consumer, you could not determine how much money you should expend to acquire them. With the SaaS support solution, enterprises spend more on getting clients than they would expend on holding the existing customers.

Before we start looking at the fundamentals, let’s comprehend what Customer Acquisition (CAC) is. Just as the term proposes, CAC is the quantity of money you use to attain a customer. According to David Skok, a recommendation for SaaS business to guarantee success is to preserve:

LTV > 3x CAC

This states that the cost of obtaining a consumer must be significantly lower than the profits that will be resulting from the consumers when they stay subscribed to your facility.

The math appears simple, but if you omit its implementation, your SaaS business will struggle to produce revenues in the long term.

Vital For Long-Term Business-Wide Development

It is a competitive marketplace for SaaS companies in 2020-21, and the price is not the only decisive factor influencing the business decisions of customers. Being a customer-centric metric, CLV renders an authoritative base to boost revenue with fewer customers, enhance the overall customer or we can say user experience, and retain valuable customers.

Build an advanced knowledge base for your customers and give them answers fast – real fast.

Take your app and help center to the next level with CloudTutorial.

How to Calculate Customer Lifetime Value?

The procedure of calculating your CLV is valuable and includes more than one statistic. Discovering your CLV will make you contemplate, not just about the sales, but about the complete customer journey – where, why, when, for how much, and how frequently do your consumers make a purchase. Responding to these queries will bring valuable perceptions, and aid you spot the problems you may not have observed before.

The Customer Lifetime Value Formula

Computing CLV for dissimilar customers assists in numerous ways, chiefly concerning company decision-making.

The four KPIs that define LTV are:

Purchase Frequency (F), Average Order Value (AOV), Churn Rate (CR), and Gross Margin (GM).

It is significant to look at each of the parameters individually to discover which one requires the most work in terms of revenue-boosting.

Customer Lifetime Value Model

Compute average order value (AOV): In order to calculate the approximate order value, you can estimate this number by dividing the organization’s total revenue in a period by the number of orders made during the same period.

AOV = Company’s Total Revenue / Number Of Orders

Compute the average purchase frequency rate (APFR): To calculate the average purchase frequency rate, you can determine this number by dividing the number of orders by the number of distinctive consumers who made consumptions during that duration.

APFR = Number Of Purchases / Number Of Consumers

Compute customer value (CV): To estimate customer value, you can evaluate this number by multiplying the average order value by the average purchase frequency rate.

CV = Average Order Value (AOV) / Average Purchase Frequency Rate (APFR)

Compute average customer lifespan (ACL): Estimate this number by doing the average of the number of years a buyer continues buying from the company.

ACL = Sum Of Consumer Lifespans / Number Of Consumers

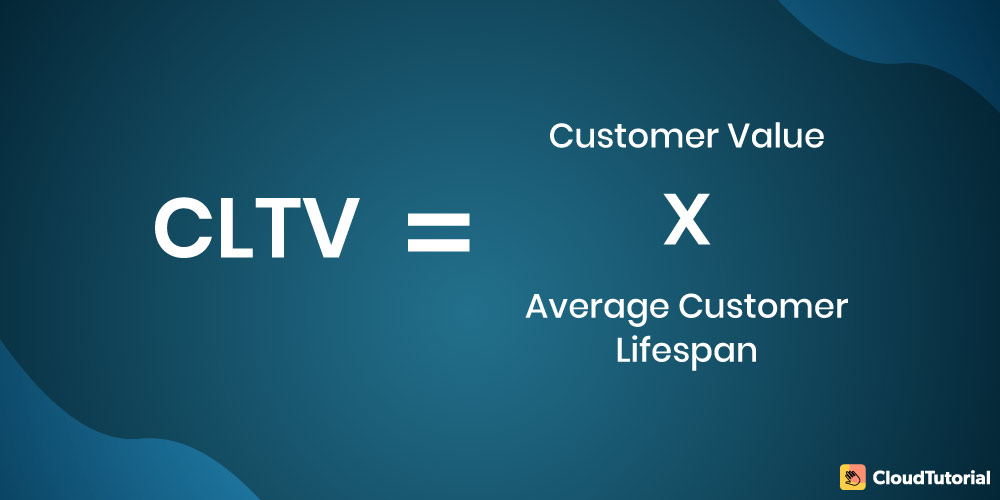

Calculate CLV: Multiply consumer value by average customer lifespan. This will provide the revenue that you can rationally expect an average consumer to produce for your business throughout their association with you.

CLV = Customer Value * Average Customer Lifespan

Customer Lifetime Value: Example

For determining the average Customer Lifetime Value, we take Starbucks as an example. Here, we would observe the weekly buying behaviors of five consumers, then would do the average of their gross margin. By implementing the formulas listed above, we can compute the average lifetime value of this Starbucks customer.

Calculating Average Order Value (AOV)

First, you are required to compute the average order value. Let’s say, a Starbucks customer uses approximately $5.90 at each visit. You can figure this by doing the average of the money spent by a consumer in each visit for 7 days. For instance, if you went to Starbucks 3 times, and spent a total of $9, your average order value would be $3.

After you measure the purchase value for a customer, you can repeat the procedure for the next five. Then add each average collectively and divide that rate by the number of consumers measured to acquire the average order value.

Calculating the Average Purchase Frequency Rate (APFR)

The second step in calculating CLV is to obtain the purchase frequency rate. In the same case of Starbucks, you are required to identify how many visits the consumer pays to one of their sites within 7 days. The average thus observed across those 5 consumers is 4.2 visits. This makes our purchase frequency to be 4.2.

Calculating Customer’s Value (CV)

As you identify what the average consumer expends and how many times they pay visits in 7 days, you can gauge their consumer value. For this, you have to observe all 5 consumers discreetly, and then multiply their average procurement value by the average purchase frequency level. This sanctions you to understand how much profits the customer is worth to Starbucks within 7 days. As you repeat this scheming for all 5 customers, you average their values collectively to get the average consumer’s value of $24.30.

Calculating Average Customer’s Lifespan (ACL)

Let’s say the Starbucks average customer lifespan notes the value as 20 years. If you were to compute; average consumer life span you would have to observe the number of years that each consumer visited Starbucks. Then you could derive the average values collectively to get 20 years. If you do not have 20 years to pause and make sure that, one method to assess the customer life span is to divide 1 by the churn rate.

Calculating Customer’s Lifetime Value (CLV)

Now that you have calculated the average consumer value and the average consumer life span, you can utilize these statistics to compute CLV. In this situation, you require to multiply the average consumer value by 52. Since you were calculating the customers on their weekly conducts, you require to multiply their consumer value by 52 to reproduce a yearly average. Then multiply this number by the consumer life span value (20) to acquire CLV. For Starbucks customers, the resultant value is = 52 x 24.30 x 20 = $25,272.

How to Improve Customer Lifetime Value?

After studying what CLV is, why it matters, and how to calculate it, now, the question arises can we improve it? We will answer this in the 3 tactics mentioned-below. Similar to any other marketing work, you must iterate as you pass through the stages. You must learn more about your consumers and improve the procedure along the course.

Make Consumers Feel Special

As you onboard new consumers, it is the time to show them their worth. In a blog post by Neil Patel, 10 tactics to increase customer lifetime value and customer loyalty, the focus lays on making consumers feel special. He further writes, “Brand loyalty is one of the most difficult assets for a company to attain. Or, at least it was. We used to have to rely on customers having a great experience with our products and services, or with our employees. Now, we can give them a great experience, but most businesses still haven’t figured out how to do it.”

From surprising customers with something they did not know they wanted in the mail to featuring fans in your content, the key to cumulative CLV is an emphasis on the individuals who support your product.

Focus On Sales

At this moment your consumers recognize how much you give importance to them, it is the time to take a deep observation at your sales. There are some methods to optimize your marketing process, as stated in this Entrepreneur article on increasing Customer Lifetime Value and boosting profits: increase sales over time, reduce costs to serve customers, and increase sales per order.

Improve The Onboarding Process

Obtaining a new consumer can be an expensive matter. As per an article printed by Harvard Business Review, they found that acquiring a customer can cost between 5 and 25 times more than holding the prevailing one. Furthermore, a study initiated by Bain & Company found that a 5% surge in retention level can lead to an upsurge in profit of 25% to 95%.

This makes it vital that your company recognizes and fosters the most valued customers that interrelate with your brand. By doing this, you will acquire more revenue resulting in an upsurge in customer lifetime value.

Compute the lifetime value by multiplying the average number of transactions, the average customer retention period, and the average value of a sale. As the lifetime value of a consumer is derived in gross revenue terms, it does not consider any operating expenditure.

Most of the prime companies recognize the significance of Customer Lifetime Value and are gradually becoming better at employing it efficiently. Contact CloudTutorial to cover each segment of your customer expedition from attainment to recurring profit management and delivering superior customer support.

To save money and time, many of such companies have started associating with SaaS companies, whose technology is available to be applied. It is rightly said that if you keep your clientele happy, your profit margins grow automatically. It is all about searching for an ultimate retention policy that functions best for your business.

Try it out before you decide.

Create a test article NOW!

Using this tool, all you have to do is add your first test article and see how it looks. Now, you don’t have to sign-up or login into CloudTutorial software just to check how your first article appears.